Justina Wamae Links Diageo Exit to Muratina and Chang’aa Consumption

Kenyan politician and former 2022 presidential running mate Justina Wamae has sparked debate after linking Diageo’s decision to sell its controlling stake in East African Breweries Limited to the widespread consumption of traditional and illicit alcohol in Kenya. Speaking through her official X account on Thursday, December 18, 2025, Wamae argued that a large portion of alcohol consumers in the country fall outside Diageo’s intended market. According to her, this reality has played a role in weakening demand for premium, regulated brands.

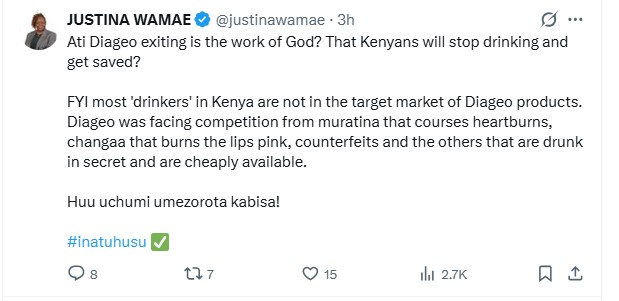

“Is Ati Diageo exiting the work of God? Will Kenyans stop drinking and get saved? FYI, most ‘drinkers’ in Kenya are not in the target market of Diageo products,” Wamae said. Her remarks immediately drew attention online, with many Kenyans weighing in on the long standing divide between formal alcohol producers and the informal market.

Why does Wamae believe local brews hurt Diageo’s business?

Wamae went further to explain that Diageo has been facing stiff competition from Muratina, Chang’aa, and other forms of alcohol that are cheaper and often consumed discreetly. She suggested that affordability and accessibility have tilted the balance away from established brands, especially in an economy under pressure. “Diageo was facing competition from Muratina, which causes heartburn, changaa, which turns the lips pink, counterfeits, and others that are drunk in secret and are cheaply available. Huu uchumi umezorota kabisa!,” Wamae explained.

Her comments reflect a broader conversation about consumer behavior in Kenya, where economic challenges continue to influence spending habits. For many drinkers, price often outweighs brand loyalty, leaving multinational companies struggling to expand their reach beyond urban and higher-income consumers.

What does Diageo’s EABL sale mean for Kenya’s beverage industry?

Wamae’s remarks came just a day after Diageo announced it had agreed to sell its 65 percent stake in EABL to Japan’s Asahi Group Holdings for $2.3 billion, roughly Ksh 300 billion. The deal, announced on Wednesday, December 17, 2025, also includes Diageo’s 53.68 percent stake in UDV Kenya Limited. Together, the transaction values EABL at about $4.8 billion, making it one of the largest foreign acquisitions in Kenya’s corporate history.

Founded in 1922, EABL is a major player in East Africa’s beverage market, producing and distributing beer, spirits, and ready to drink products. Its portfolio includes widely recognized brands such as Tusker, Senator, Serengeti, Kenya Cane, and Chrome. For the year ending June 2025, the company reported net sales of Ksh 128.8 billion and EBITDA of Ksh 33.3 billion, while employing more than 1,500 people across the region.

Despite the change in ownership, EABL will remain listed on the Nairobi Securities Exchange, as well as stock exchanges in Uganda and Tanzania. Asahi has stated it will work closely with existing management and employees to support sustainable growth. Long term licensing agreements will also allow EABL to continue producing and distributing Diageo brands including Guinness, Johnnie Walker, and Smirnoff Ice.

Diageo has emphasized that the sale aligns with its strategy to divest non-core assets and reduce leverage while maintaining a presence in the region through licensing. As reactions continue to unfold, Wamae’s comments have added a social and economic layer to the discussion, highlighting how local consumption habits and economic realities intersect with global corporate decisions.

By Risper Akinyi